Table of Contents

- Tax Deadline 2024 Extension Form - Ardyce Lindsay

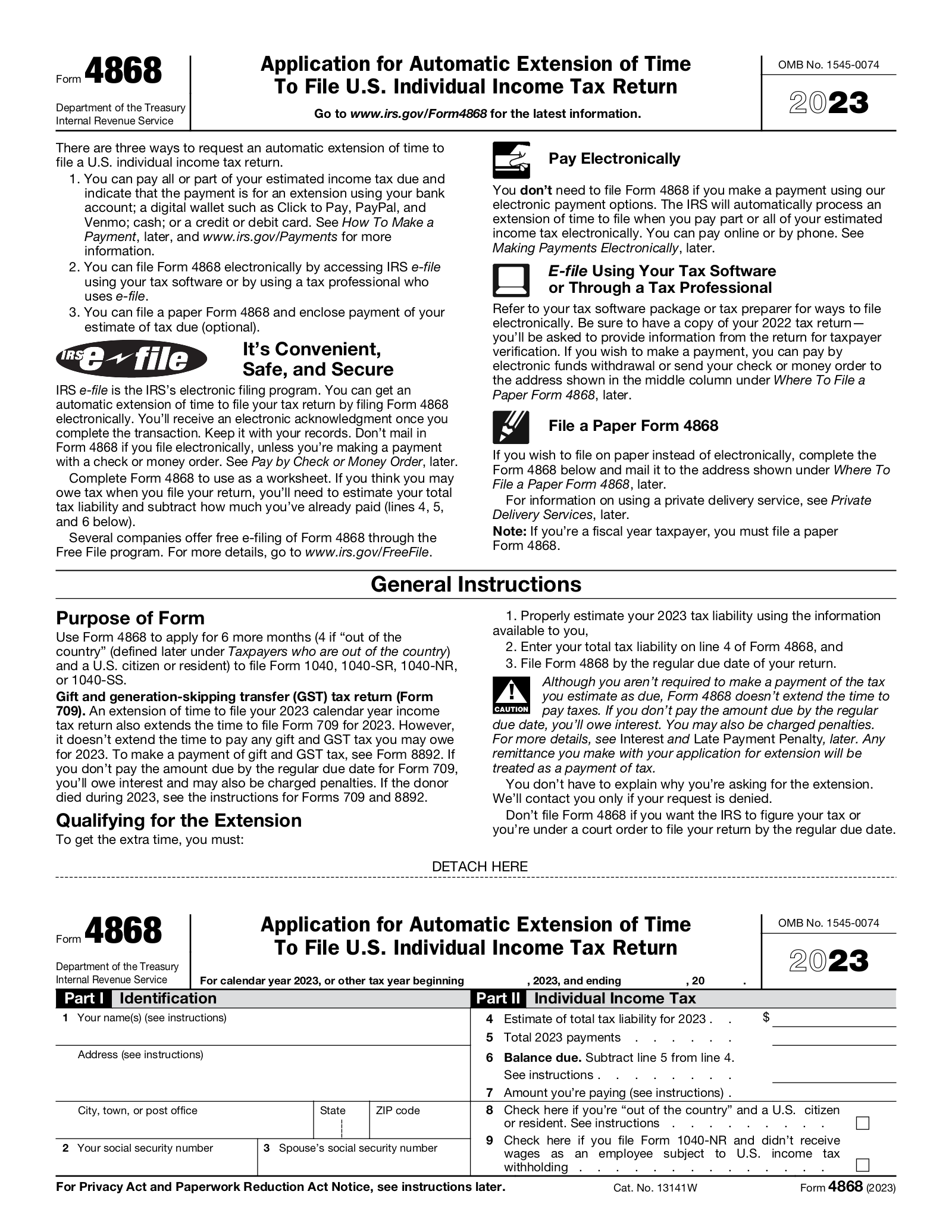

- File Extension Taxes 2025 Free Pdf - Sophia M. Gaertner

- 10 Things to Know about Filing a Tax Extension - Hallows Company

- Filing a Tax Extension

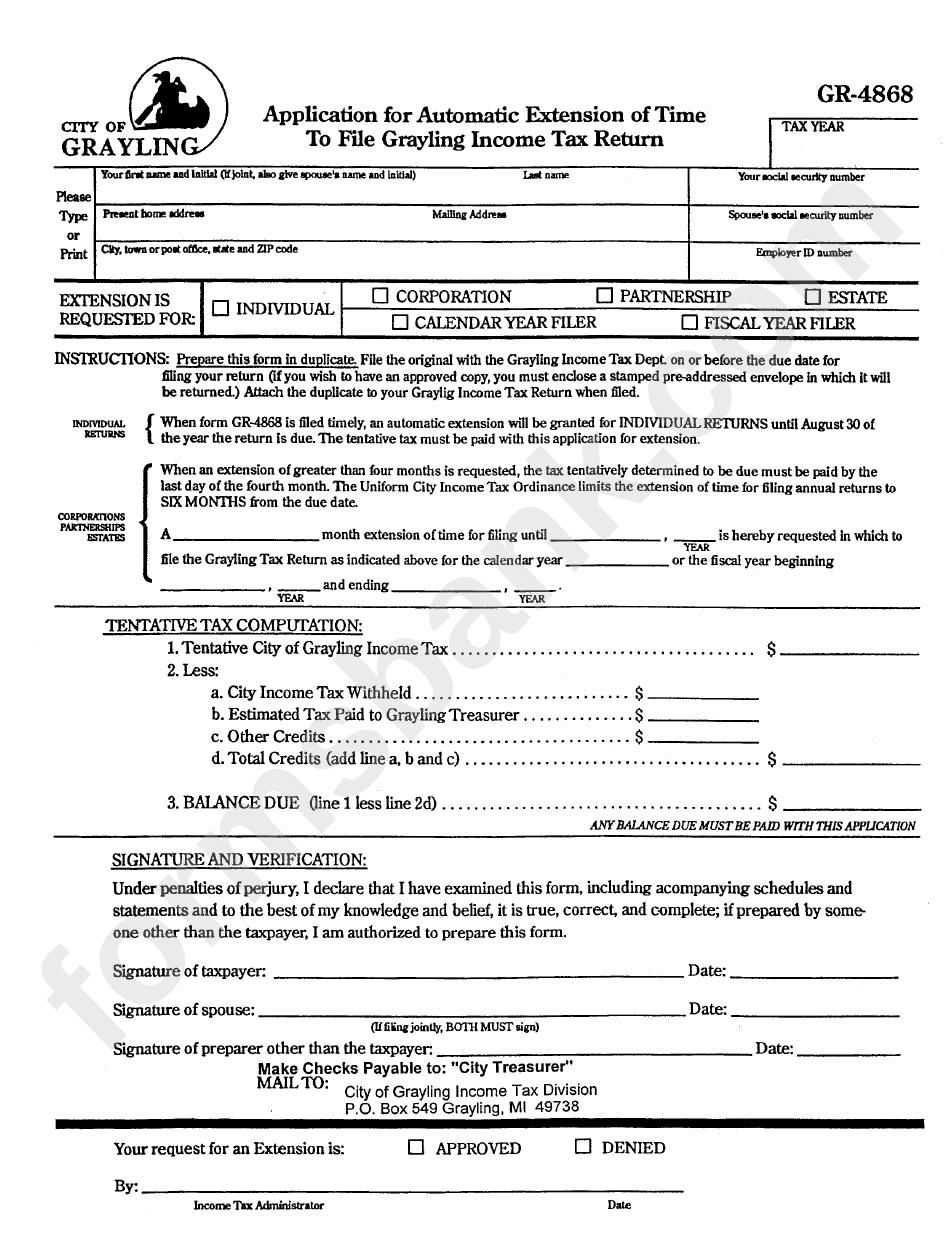

- Printable Tax Extension Form

- How Many Times Can You Ask For An Extension On Your Taxes?

- Tax Extension Form - Cam Noelani

- Tax extension grunge rubber stamp on white background, vector ...

- Is Filing an Extension a Bad Thing? What Do I Need To Know About Tax ...

- Do I Need to File a Tax Extension?

Taxpayers in certain states have been granted an extension to file their taxes due to severe weather conditions, such as hurricanes, floods, or wildfires. The IRS has announced that taxpayers in these areas will have until May 15th or May 31st to file their tax returns, depending on the state. This extension applies to both individual and business tax returns, giving affected taxpayers additional time to gather necessary documents and complete their tax filings.

States with May Filing Due Dates

- Alabama: May 15th - due to severe storms and tornadoes

- Arkansas: May 15th - due to severe storms and flooding

- California: May 31st - due to wildfires and mudslides

- Georgia: May 15th - due to severe storms and tornadoes

- Louisiana: May 15th - due to severe storms and flooding

- North Carolina: May 15th - due to severe storms and tornadoes

- Oklahoma: May 15th - due to severe storms and tornadoes

- Tennessee: May 15th - due to severe storms and tornadoes

- Texas: May 31st - due to severe storms and flooding

What to Do If You're Affected

It's essential to note that while the tax filing deadline has been extended, you should still make timely payments to avoid penalties and interest. You can make payments online, by phone, or by mail. Additionally, if you're expecting a refund, you can still file your tax return as soon as possible to receive your refund promptly.

The tax deadline extension is a welcome relief for taxpayers in affected states. If you're one of them, make sure to take advantage of the extra time to file your tax return accurately and on time. Remember to stay informed about any updates or changes to the tax deadline, and don't hesitate to reach out to the IRS or a tax professional if you have any questions or concerns.By staying on top of your tax obligations, you can avoid unnecessary penalties and ensure a smooth tax filing experience. So, mark your calendars for the new due dates, and get ready to file your tax return with confidence.

Note: The information provided in this article is subject to change, and taxpayers should always check with the IRS or a tax professional for the most up-to-date information on tax deadlines and extensions.